The meme coins market has seen a tremendous boost of growth lately. One breed of meme coins is the most popular amongst influencers and online communities. Dogecoin and Shiba Inu are the two names for this breed.

What characterizes a meme coin, and how does it compare to big coins like Bitcoin and emergent privacy coins like Monero (XMR) in an XMR wallet? To answer these questions, here’s an overview of the curious case of meme coins.

What are Meme Coins?

One of the most popular types of cryptocurrencies is the meme coin. Memes are currently integral parts of Internet culture. Dogecoin, the first meme coin, appeared in 2013 as a joke based on an Internet meme portraying a Japanese Shiba Inu dog.

Meme currencies are notoriously volatile. They are mostly community-driven, and they quickly develop popularity owing to online community recommendations and FOMO (fear of missing out). However, when traders shift their focus to another meme coin, their price may drop abruptly.

Cryptocurrency is a hot topic in the news right now; sometimes, it’s difficult to understand how people invest or trade in it. You might ask, "Why should I bother with a currency whose value is based on internet jokes?" There is a lot of speculation involved here. People often invest because they believe that the coin's popularity will increase and thus generate profits.

Even though this sometimes results in gains such as with Shiba Inu (SHIBA) in Dogecoin, more often than not, these meme coins sink into oblivion. For similar reasons, many crypto enthusiasts debate whether it's a good idea to diversify one's portfolio with meme coins.

What Started the Meme Coins Movement?

Dogecoin was introduced in late 2013 after software programmers devised it as a pun on the Doge meme. This spurred the invention of numerous more meme coins in the following years.

How Do Meme Coins Work?

Cryptocurrencies are not a viable form of currency but are more accurately described as stocks and other investment opportunities for people who can discover the magic formula for creating money out of thin air. These currencies use a blockchain database that keeps track of all transactions made.

Meme coins are similar to cryptocurrencies because they use blockchain technology and involve working with digital currencies. In fact, there are a few meme coins floating around on Ethereum’s blockchain at the moment, along with the Solana blockchain. The technique of "mining" is used to generate these coins and other cryptocurrencies. Dogecoin, for example, is mined by individuals or groups completing challenging mathematical and algebraic formulae.

Like most other investment choices, Meme coins are a way to invest in cryptocurrencies. As previously stated, these currencies are typically created with no business cases in mind; therefore, most investors purchase in the hopes of making a fast buck.

Meme coins can't be claimed to be a good store of value because they are often community-driven and driven by internet excitement.

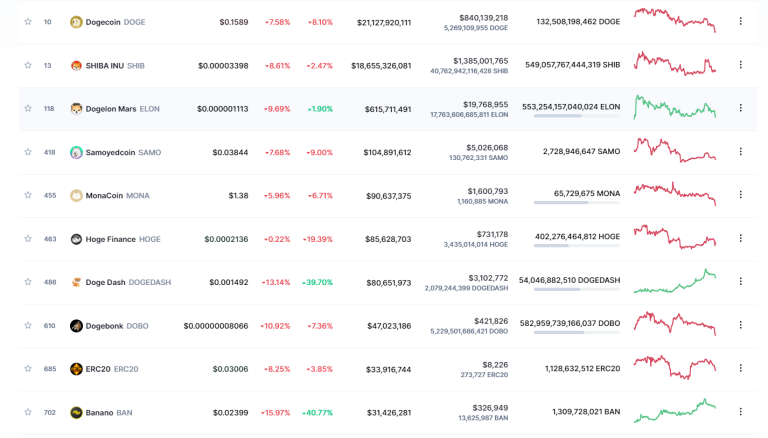

The number of meme coins on the market today is staggering - over 200, in fact! Before, one had to be a little tech-savvy to start making their own coin. There are apps and platforms that let you dive headfirst into this exciting world easily.

Features of Meme Coin

Meme coins usually have an unlimited or almost infinite supply. In contrast to Bitcoin, which was meant to have a restricted amount of units accessible for mining, meme currencies sometimes have billions of units in operation. Because these currencies lack a mechanism that "burns" or permanently eliminates them from circulation, the values continue to climb.

A name of a coin that includes the terms "DOGE" or "SHIBA" is almost certainly a meme coin. The project's website is a fantastic way to learn whether or not anything is a meme coin. It's most certainly a meme coin if the developers invest little time outlining practical utility for the money and their page has frequent connections to Elon Musk and adorable animals.

Meme Coins Examples

Here are some of the popular meme coins you can choose from:

Dogecoin

Dogecoin was the most popular meme coin and sparked a mini-revolution in the cryptocurrency industry. It was first introduced in 2013 as a trial. It features a dog on it because Jackson Palmer reasoned that most people adore dogs and, therefore, it would readily gain popularity. Dogecoin's value is increasing; this is why most users like to invest in it.

Dogelon Mars

Dogelon Mars received a flood of new public investors after a surge in investment due to the popularity of Dogecoin and Shiba Inu. All things that share even the slightest resemblance to those cryptocurrencies began attracting attention. This attention spurt can be attributed to a powerful social influence; for example, one of the most influential crypto celebrities in the known galaxy, Elon Musk, was discussing crypto publicly.

Floki Inu

Floki Inu is a meme cryptocurrency inspired by Shiba Inu and Elon Musk that purports itself to be “not a meme currency but a movement.” It calls itself the “Floki Vikings” in honor of Floki, after whom the dog was named about his character (Viking) from the History Channel’s show, Vikings. This meme cryptocurrency has been included multiple times in the top ten of LunarCrush's social engagement leaderboards, indicating that it takes its community activities seriously.

Advantages of Meme Coins

These meme coins are frequently based on online memes and begin as pranks or jokes. Though professional cryptocurrency investors should avoid such purchases, these currencies may be extremely profitable over short periods of time, resulting in enormous returns.

For example, in 2021, the price of Dogecoin increased by approximately 1,500 percent. Furthermore, the Shiba Inu profited by more than 500 percent at its height. As a result, even a little investment in these meme coins in your portfolio might result in huge returns.

Disadvantages of Meme Coins

Meme coins are one of the most volatile forms of currency today. They experience high-revenue gains during favorable market conditions and severe revenue loss during unfavorable or uncertain times.

The way meme coins are structured is one factor that has such severe value fluctuations. Unlike fiat currencies and other cryptocurrencies, meme coins sometimes have an unlimited supply, which means there is no limit to the number of them that may exist.

It's important for investors to remember that meme coins are involved in online memes. As a result, they share many characteristics with them, such as the capacity to go viral and the ability to become obsolete soon. However, investing in meme coins can be done responsibly, and you can make money off of meme coins if you do it right and invest carefully, you will reap the rewards!

Are Meme Coins Smart Money Holders?

While some meme coins, such as dogecoin, appear to have outlived their expected lifespan, most meme coins were intended to live a life span of only a few months. Unlike traditional forms of currency, meme coins can only be used to purchase other meme coins or sold back at an exchange.

Not all meme coins, though, are fake. Some of these meme coins, such as Floki Inu, and Dogecoin, provide important functionality while focusing on the "meme" part to increase user adoption. According to the community, meme coins are a crucial tool to get investors interested in cryptocurrency.

The Risks of Meme Coins

Meme coins are rather volatile in price due to their relative novelty. Their popularity is very much driven by word of mouth and celebrity-driven marketing, making the price hard to predict at any given time. A coin may rise rapidly in value, such as Dogecoin, only to suddenly crash when interest falls, or the market turns bearish on an asset class in general. Moreover, unlike Bitcoin technologies (blockchain), meme coins have no predefined ecosystem – they tend to be standalone and ungrounded, meaning they might not hold value as a medium of exchange if people stop valuing them.

Meme coins that do not have considerable real-world value can quickly lose all their value because supply and demand determine their prices. Also, most meme coins are unlikely to be viable in the long term profitably; at some point, it may prove too difficult for them to compete against other cryptos concerning mining costs and transaction fees.

Conclusion

Before investing in cryptocurrency, especially meme coins, ensure you have a sound financial base. Investing in meme coins can be very rewarding but also risky. They can offer a low investment and substantial gains on the open market, but only for investors who are really good at keeping track of their finances and trade daily.

However, trading digital currency is only recommended for highly skilled investors and traders as it involves a lot of challenges and risks that more than likely won’t be worth it for novice traders. Consider having an almost total loss of all your initial money! Importantly: pay careful attention to the conditions, regulations, and restrictions concerning the purchase or sale of specific cryptocurrencies offered by various exchanges or bought directly.

Leave a Reply