Throughout the years, blockchain technology has established itself as the most adaptable technology, inspiring immense faith in the financial industry. Despite the fact that decentralization, simplicity, and untrace ability appeal to global financial institutions, developing a financial business plan is a vital business strategy to pursue.

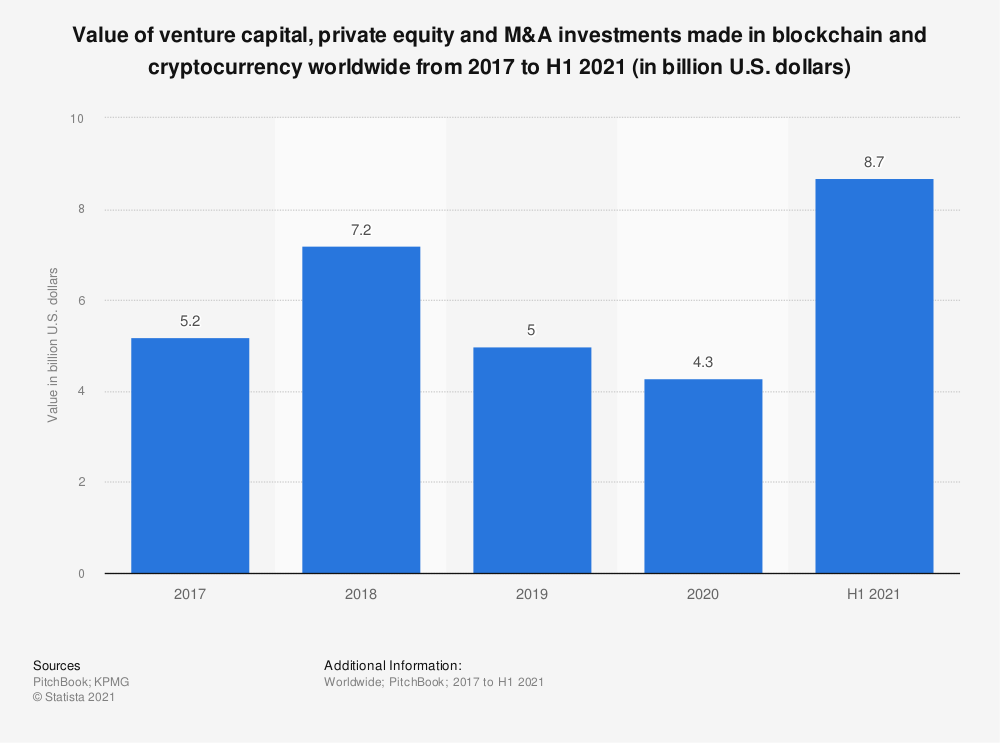

As per the Global VC, PE and M&A investments in blockchain and cryptocurrency 2017-2021.The blockchain and cryptocurrency industries garnered nearly twice as much financing from venture capital, private equity, and mergers and acquisitions in the first half of 2021 as they did in the first half of 2020. These industries garnered around $8.7 billion in worldwide investment in the first six months of 2021. Previously, the biggest concentration of investments in this fintech area was recorded in 2018, when the sum was about seven billion dollars.

Image Source - https://www.statista.com/statistics/1260400/global-investments-in-blockchain-cryptocurrency/

Understanding Blockchain

Blockchain technology is private, public, and similar to a ledger in that it is decentralized. Bitcoin and perhaps other cryptocurrency transactions among numerous computers that are linked to a peer-to-peer network may be recorded using this method. As a result of the use of intermediary technologies, money may be exchanged with the confidence that trading will be powerful and precise in the financial industry.

If you are seeking the best custom software developers, you should look no further than Diceus. They provide specialist software and aid IT firms in expanding their workforce and offering more comprehensive services.

A blockchain is a distributed database that is shared among computers connected to a network of computers called nodes. A blockchain, like a database, is a digital storage system that stores information in electronic form. Blockchains are well-known for performing a vital purpose in cryptocurrency systems such as Bitcoin, which is to maintain a secure and decentralized record of all transactions made inside the system. The blockchain's uniqueness lies in the fact that it maintains the correctness and security of a data record while also producing confidence without the need for a third party to be trusted.

In comparison to a standard database, the organization of data in a blockchain is substantially more complex. A blockchain collects information in the form of groups known as "blocks," each of which contains a collection of information. In order to prevent a block's storage capacity from being exceeded, it is closed and linked to the previously filled block, creating what is called the "blockchain" of data. After the newly added block has been constructed into a freshly formed block, it is then added to the chain it has been completed.

An ordinary database normally organizes its data into tables; however, as the name implies, blockchain organizes its data into chunks (blocks) that are then connected together to form a single unit of information. This data structure, when applied in a decentralized fashion, results in an irreversible chronology of data that cannot be reversed. As soon as a block is finished, it is etched in stone and becomes a part of the chronology of events. The timestamp of each new block added to the chain may be found by looking at the previous blocks in the chain.

Blockchain Decentralization

Consider the case of a firm that has a server farm with 10,000 computers that are used to handle a database that has all of the account information for all of its customers. This firm owns a warehouse building in which all of these computers are housed, and it retains total control over each of them as well as the data they contain on their servers.

This, on the other hand, provides a single point of failure. What happens if there is a power outage at that particular location? Is it possible that its internet connection has been lost? What happens if it catches fire and burns down to the ground completely? What happens if a bad actor uses a single keystroke to completely erase all data? In any case, the data has been corrupted or lost.

When using a blockchain, the data included in that database is distributed over a large number of nodes situated throughout various geographical locations. Because of this, not only does the database have redundancy, but it also has integrity: if one instance of the database has a record modified, the other instances are not impacted, which prevents a malicious actor from modifying the record in question. The transaction record of Bitcoin may be tampered with by a single user; however, all other nodes will cross-reference each other and will be able to quickly identify the node that contains incorrect information. An exact and observable sequence of events is established as a result of the implementation of this system. In this way, no one node in the network has the ability to change the data it holds.

Consequently, the information and history of bitcoin transactions are irreversible once they have been created. Even while such a record may be a list of transactions (as with a cryptocurrency), a blockchain might also hold a variety of other forms of data, such as legal contracts, state identifications, or the inventory of products held by a company in its warehouse. These advantages will be very beneficial to financial institutions such as banks and financiers , as well as startups building blockchain games.

Some instances of how corporations are using the blockchain to their benefit are as follows:

Money Transfer

The ability to trade currencies has proven to be a significant benefit of the blockchain. A lot of obstacles and challenges are encountered by both clients and financial institutions while transferring money overseas, which is frustrating. Hundreds of millions of dollars are exported every day, and the procedure is typically time-consuming, laborious, and prone to errors.

Blockchain is the foundation for digital currency systems, which in certain cases may completely replace the need for fiat currency exchange. Using blockchain financial solutions or mobile transactions, consumers may now make electronic payments on their mobile devices, avoiding the time-consuming practice of traveling to a transfer center, lining up, and paying to have their transactions processed.

Direct payments at low cost

Direct payments, such as those made by check or Mastercard, protect you from risks and expenditures incurred by both your company and your customers. Allowing direct blockchain-based payments may aid in the resolution of these issues while also increasing the speed with which products are paid for and delivered. The majority of the assets are held by financial institutions, such as banks or credit card companies. All of these categories enhance the complexity of communication while also increasing the likelihood of cost increases.

Details of the transaction

Through the placement of title documents on the blockchain, banks can keep track of the purchase and sale of any property. This guarantees that they have an exact and unchanging record of their availability. Instead of just moving money, blockchain has the potential to revolutionize a bank in a variety of ways. Blockchain technology is a fantastic tool for tracking transactions and ensuring that information is accurate and secure.

Excellent deals

Despite the fact that actions may be costly, time-consuming, and complex, Blockchain is exploring self-employment. The timing of when a buyer pays and when a seller delivers, as well as any difficulties that develop along the line, may all be monitored by smart contracts. The frameworks are fully automated, eliminating the possibility of human mistakes, and are available 24 hours a day, seven days a week.

Financial Involvement

New enterprises may compete with established banks because of the cheap prices of blockchain technology, which facilitates financial understanding. Because of constraints such as a minimum necessary amount, restricted access, and banking fees, many people seek alternatives to traditional financial institutions. Blockchain technology, which can be accessed via computers and mobile devices, may provide a seamless alternative to traditional banks.

Fraud is quite uncommon.

Many financial institutions are unable to defend themselves against digital assaults because they depend on a well-founded information base to make decisions about their operations. Each block of the blockchain records the exchange of information in a block, adjacent to a single kind of hash connected with the previous block, and then records the information in the following block. Returns on payments are delivered to each and every customer in the company. When digital hazards are removed, the cost of working jointly reduces, enabling two participants to save money away and relieve pressure.

Cryptocurrency

A new generation of blockchain-based assets has emerged in recent years, with digital currencies being the most recent. While digital money is already widely used, blockchain firms are lowering the barrier to entry by making it easier for cryptocurrency traders to transact smoothly, which is frequently referred to as "another financial system." This is the most recent in a long series of blockchain-based financial services, and it is also the most recent in the field of digital finance. In terms of worldwide businesses' investment plans for blockchain technology, around 36% of respondents stated their companies expected to invest more than $5 million in the technology by 2021.

Taking into consideration the future

Large quantities of trade are increasingly being handled by banks, and blockchain technology has the ability to make these exchanges more safe and secure. In recent years, an increasing number of financial organizations, regardless of whether or not they abide by banking rules and regulations, have begun to see the potential of blockchain technology and digital currencies. The ability of the blockchain to reduce risks and fraud means that we can be certain that it will generate interest and become a new household name in the financial sector.

Leave a Reply